State of independence

Consider a takeover or risk being overtaken: this has been the message to domestic firms looking to compete in Europe. But no longer. ‘The Diplomat’ talks to the bosses of companies who (in most cases) will go it alone in the EU

Romanian enterprises will have to look, whether they like it or not, at the opportunity of selling out.

Many big firms from Europe will be circling the waters of Romania next year, hoping to take on the best performing private companies.

Playing on local businesses' fears of the influx of competition during EU-accession, these acquirers could buy up a firm at a pretty price - even though, out there in Romania, there are just as many bargains as basket-cases.

The most dynamic local companies already have their survival strategy in place and most successful Romanian entrepreneurs have a variety of choices.

This mainly involves making a massive cash injection into the firms in the next year, to immunise them against the buying power and staying power of western multinationals, such as a listing on the stock exchange, franchising, selling a minority stake to a strategic investor or expanding abroad.

But few companies will go on the record and say they are up for sale.

Electrowares retailer Altex does not rule out a sale to an investor, but says it could still play as an independent. Electrowares retailer Altex does not rule out a sale to an investor, but says it could still play as an independent.

“For the electronic appliances sector, there are two alternatives,” says Dan Ostahie, general manager of Altex.

The first is to sell to strategic investor, such as a large international brand. This could include UK's Electroworld, Germany's Mediamarkt or France's Fnac.

“They will come with their own philosophy and integrate the team, introduce some new routines and exercise their business models,” says Ostahie.

The second is to remain independent, with an expansion plan domestically or in neighbouring countries. This is something rival Domo is undertaking and Altex plans to do.

With this, there is the imperative to connect with “buying centres” in order to compete on a European level. This means an alliance with similar independent companies from other European countries to buy the wholesale electronic products at a cheaper price from suppliers.

“We do not exclude either option,” says Ostahie. “I don't think there is a third choice.”

In February next year Ostahie will finalise the details with two large investment companies to buy part of the Altex group. The firm will then use this capital to fund a comprehensive expansion strategy.

“We have to have consistent expansion,” says Ostahie. “There is no point just opening in Bulgaria as a single shop.”

At present there is a lack of foreign players in the electronic retail market in Romania, who may be looking to start up a greenfield investment or purchase an existing estate of stores.

“If the country is still not very attractive [to international retailers], it is because it is not consolidated enough,” says Ostahie. “It has reliability and growth, but has to show growth. The big players are still looking to see how the integration will go.”

Will next year be the crunch year for companies?

“The earlier retailers come here, the better it is for them,” says Ostahie. “They have a competitive advantage in organisation, positioning and brand awareness. Metro and Carrefour have taken a lot of advantage of this. No big international retailer is complaining about their balance sheets. There is no reason to believe that delaying entry could offer an advantage.”

Planning to move abroad for over a year, Altex is now evaluating Serbia Montenegro and Bulgaria. “Expanding without good control is not healthy. But now I have a team able to activate expansion. It's like having a car that's Formula One,” says the general manager.

Expanding on the local market for retail brands is hard to do with only one's own funds.

“The mission of Romanian businesses is to enlarge the market,” says Ostahie. “Both Flamingo and RTC Holding have succeeded to do this. RTC through merger and acquisition, by joining with Best Computers. While Flamingo went on the local stock market. This will bring more money to the stock market, make Romania more attractive and increase GDP and productivity of Romania. I am waiting for other companies to follow this. Over the next two years Romania will be the most dynamic mergers and acquisitions market in eastern Europe.”

Shopping around

Romania's second largest electrowares retailer, Domo, is currently undergoing a re-branding process, aiming at extending its range of products and expanding abroad, CEO Lorand Szarvadi tells The Diplomat. Romania's second largest electrowares retailer, Domo, is currently undergoing a re-branding process, aiming at extending its range of products and expanding abroad, CEO Lorand Szarvadi tells The Diplomat.

The company increased its cash-flow last year with a share capital increase and sold 20 per cent to the Romanian American Enterprise Fund (RAEF).

The CEO says Domo's aim is for shareholders to create an exit in the next four years, so the company will be either listed on the stock exchange or undergo cooperation with a strategic investor.

“There was interest from an eastern European investor and we are negotiating, but maybe we should wait for a strategic western investor,” says Szarvadi.

Bulgaria is next on Domo's expansion map.

“The plan is to open ten stores in Bulgaria by the end of 2006 inside Kaufland supermarkets,” says Szarvadi.

In the pink

Meanwhile IT retailer and distributor Flamingo has already ventured on foreign markets.

“It started five years ago with the Republic of Moldova, and then we continued with Bulgaria, Serbia, Macedonia and Croatia, where we set up distribution subsidiaries,” general manager Dragos Simion tells The Diplomat. “This year we opened branches in Bulgaria and Serbia.”

A hobby turned into a successful business, Flamingo is now listed on the Bucharest Stock Exchange.

“We achieved a level of development that allows the firm to sell part of its shares,” says Simion. “We chose the BSE as we consider it is the most efficient financing solution to sustain expansion. Attracting a foreign investor was too premature.”

Now Flamingo owns 90 stores in Romania. Five of these are operated under a franchise system a development style that Simion is looking further at with interest.

Plans for next year include a consolidation of the business in Romania, says Simion. “We also want to achieve a critical mass in Bulgaria and Serbia, by having between 20 and 25 stores in those countries,” says the general manager.

Business by the book

Octavian Radu can pride himself with forming a company that now ranks in the top ten of wholly Romanian-owned businesses - RTC Holding.

Setting up in 1990 selling toys, pens, TVs, cars, rubbers, shampoo and chewing gum, Radu reinvested everything and now has 65 companies, including book and stationery shop Diverta, record company Zone Records, video rental store Hollywood Music & Film and wine shop Vices and More. Its latest acquisitions are IT retail shop Best Computers and IT&C distributors Systec and Simtech.

RTC is one Romanian company which could expand abroad, and the first step is the Republic of Moldova.

“I see this country as part of Romania and their development level is similar with Romania's a few years ago,” says Radu. “There is little competition from foreign investors. It's like deja-vu.”

But Radu is not sure if he will continue the expansion to other countries. “This is something I ask myself daily. I have preferred until now to develop other businesses in Romania.”

Radu says he eyed Hungary at the beginning of this year.

“I was about to buy a stationery company, but I stopped because I felt something dirty was going on,” he says. “In Romania I would have realised faster that something was wrong, but there I needed a translator.”

Also he is taking into account the possibility of selling some companies from the holding because they are mature. “I already have offers for the transport company, but I won't sell it now. I'll leave it two more years to develop,” he adds.

Diverta, on the other hand, will never be for sale.

“I will have it even when I will retire,” says Radu. “I created Diverta especially not to alienate it - the book business all over the world is local.”

Altex

Electrowares retailer

Stores: around 140 (Media Galaxy and Altex)

2005 predicted turnover: 275 million Euro

2005 predicted profit: four to five per cent

Ownership status: Private. Looking at alliances or strategic investor. Aims next year to sell minority stake to investment firms.

Domo

Electrowares retailer

Stores: 108

2004 turnover: 101 million Euro

2005 predicted turnover: 130 million Euro

Ownership status: Private. Looking for a strategic investor. Last year sold 20 per cent stake to Romanian American Enterprise Fund

Flamingo

IT retailer and distributor

Stores: 90 stores throughout Romania. New units in Bulgaria and Serbia. Distribution has international reach across eastern Europe

2004 turnover: 61 million Euro

2005 predicted turnover: 80 million Euro

Ownership status: Private and has a listing on the BSE

RTC Holding

Comprises 65 companies

Including bookshop and stationery store Diverta and Best Computers

2005 predicted turnover: 200 million Euro

Ownership status: Private Some companies might be sold in future years

Power base

Romania's largest private company, locally-funded and Netherlands-based Rompetrol Group, was founded back in 1974 as Romania's international arm in the oil and gas industry and privatised in 1993 through the mass privatisation, MEBO, method. Romania's largest private company, locally-funded and Netherlands-based Rompetrol Group, was founded back in 1974 as Romania's international arm in the oil and gas industry and privatised in 1993 through the mass privatisation, MEBO, method.

But it only managed to recover its turnover after the current management took over in 1998.

In the following year, “to aim at international expansion”, the company settled its headquarters in Holland, says president and CEO Dinu Patriciu.

In 1999 the company bought out the Vega Ploiesti refinery. Currently undergoing a modernisation programme, Vega can now process about 10,000 barrels or oil a day. This is not in the production of car fuels, but a range of special boiling point spirits (SPBS), solvents for olefins polymerization, bitumen, heating oil and catalysts for petroleum processing. The refinery, which employs 389 people, posted a turnover of almost 40 million Euro in the first half of this year.

Built in 1975 on what used to be a swamp in the Navodari area on the Black Sea coast, Petromidia is the largest refinery on the Black Sea. Rompetrol took it over in 2001, and changed its name to Rompetrol Rafinare Complex Petromidia. In 2004 it listed shares on the Bucharest Stock Exchange and has just finished a modernisation programme, including an increase in the refinery's processing capacity to four million tonnes per year from the existing 3.6 million tonnes.

Rompetrol now has representative offices in neighbouring countries and exploration fields worldwide. Subsidiaries opened in the Republic of Moldova and Bulgaria in 2002 and 2003 respectively, while this year it opened its Albanian office in February and the Moscow office in April, to conduct local business activities and continue to explore expansion in the crude oil exploration and production field in the region.

Rompetrol mixed interest oil group

Predicted turnover for 2005: 2.5 billion Euro

Market share: 32 per cent of the Romanian refined products market

Ownership status: Mixture of private investors and stock on the Bucharest Stock Exchange

Staying the course

Continental Hotels is continuing to partner with French hotel giant Accor to open Ibis hotels around the country, but is also looking to expand into the two-star 'Express' hotel market.

With a listing due on the stock exchange for next Spring, Radu Enache, as president and CEO Continental Hotels and major shareholder of the hotel chain, says that he has no plans to sell out.

“Investing in the tourism industry is quite difficult, as one cannot see the return on investments in a very short time,” says Enache.

Nevertheless, Enache has pursued a development policy of increasing the number of rooms and maximising the space available. Now Continental has an agreement with Accor to develop ten hotels for them in Romania by 2008.

Firstly, Continental will build Ibis hotels in the cities where it is already present with its own brand.

Continental will also build ten hotels under its own name. Enache says he is “close to completing” the first development stage which comprises modernising the Continental Hotel in Bucharest, integrating the Bulevard Hotel in Sibiu into the chain and turning this into a four-star hotel under the Continental Bulevard Hotel name.

Brasov and/or Cluj-Napoca will be the location of a new built Continental hotel; two more hotels will open in Timisoara by the end of 2006, a Continental and an Ibis, according to the president.

The hotel chain is also looking to open its Continental Express two-star hotel brand, under a 'bed and breakfast' concept. The locations for this are not yet fixed. This will open in cities with above 250,000 inhabitants. Bucharest will be first, followed by Craiova, Braila, Galati, Bacau, Bistrita, Deva, Zalau, Satu Mare and Baia Mare.

Enache says the stock market listing, planned for Spring 2006, will probably coincide with an exit by the funds that own shares in the hotel chain, namely RPPF, SIF Transilvania and SIF Banat-Crisana.

“We have discussed several collaboration possibilities with Accor, but the truth is we, as a local brand, cannot tell Accor, which is the world's second hotel chain, what to do,” says Enache. “It remains to see what their strategy will be regarding their position in Romania.”

Continental has invested 18.5 million Euro this year alone in bringing on the local market the Ibis Parliament and Ibis Constanta hotels, in addition to the already invested 14.2 million Euro for Ibis Gara de Nord.

“We're definitely looking at a change of ownership in the Spring of next year, with the listing on the BSE, but I, who own the majority stock together with my family, do not intend to sell the chain,” Enache adds.

Continental Hotels

No of hotels: 14 with a total of 1,544 rooms

No of employees: around 1,000

Predicted turnover for 2005: 22 million Euro

Predicted net profit 2005: Seven million Euro

Ownership status: Private. Looking at stock exchange listing in Spring 2006

Aiming for a bigger steak

Set up by Dragos Petrescu in 2004, based on his experience with La Mama, where he was one of the partners, City Grill is slowly taking up many of the prime restaurant spaces in north Bucharest, while future plans could include quick service formats and a move abroad, its CEO tells The Diplomat.

This month a restaurant opens in the capital's historical centre, Lipscani, in an investment worth 450,000 Euro. In total, about 1.5 million Euro is planned for investments in five new restaurants, while franchises are also in the works.

Next year the north of the city will see a City Grill boom with outlets in Oracle Tower, which will lodge a cafeteria, a restaurant and cafeteria in America House and a restaurant in Feeria shopping centre, Baneasa.

Petrescu says the City Grill is targeted at clients with medium to high incomes.

“From our research, 42 per cent of people likely to go to restaurants in Bucharest fit this profile - a person who earns at least 300 Euro per month and is looking towards healthy eating. If La Mama was launched as a restaurant that provides the lowest price for good quality and quantity, City Grill was launched as a restaurant addressing an educated client who looks for quality at a fair price in an elevated atmosphere.”

Development plans include outlets outside the capital in the next ten years, such as Constanta, Cluj-Napoca, Pitesti, Brasov, Ploiesti, Arad, Timisoara, Sibiu, Brasov and Craiova.

“We'll begin with Constanta, in the Carrefour gallery, and then in Tabacariei Mall, a location for which we are in advanced talks. We also concluded a financing agreement with Raiffeisen Bank, who will fund our projects from now on.”

Petrescu says the company is also looking at adopting other formats.

“In the future we plan to go into the quick service field, opening in smaller malls or airports, but this will not happen sooner than three years from now.”

The CEO also says City Grill outlets may appear in neighbouring countries such as Serbia, Montenegro, Bulgaria and the Republic of Moldova, but will wait some time before making a firm decision.

Home from home

Trying to recreate mother's kitchen in the centre of the capital has been the ambition of Catalin Mahu's La Mama restaurant network.

First opening in 1999 with an investment of around 40,000 USD, there are now four restaurants in the chain, two more in Bucharest and plans to open another four next year, serving up traditional Romanian specialities such as sarmale, ciorba and mici.

“We don't want to deliver luxury to our customers, but good normal food one can find at home,” says Mahu. “If you check my menu you will see more or less the copy of a family menu.”

Realising that the EU will bring new regulations in food preparation and sourcing, La Mama has chosen to take further control, by opening its own production unit in Bucharest, in a 300,000 Euro investment, where it produces its own sausages, 'mici' and prepares vegetables.

The company's expansion plan favours the central and what Mahu calls the 'ultra-central' areas of Bucharest, such as near Blvd. Magheru. Other interest is in the most visible areas of city, such as at busy crossroads.

Mahu's intention is that Bucharest will see around ten to 15 La Mama restaurants by the end of 2007. Also in 2006 the company intends to open restaurants in cities such as Brasov, Timisoara, Constanta and Iasi, as well as areas where tourists gather.

“We are taking into account the franchise option for the country at large, but not in Bucharest,” Mahu says.

Other plans for the manager could include a coffee shop network and a home delivery system for La Mama.

The chain is staying Romanian.

Mahu intends to keep La Mama for himself. “My intention is not to build a brand and then to sell it,” he says. “After the borders will disappear, nobody will stop me from opening a restaurant in Paris, London or another part of Europe, but first I must have the possibility to support myself here and then I will have the choice to not open in, say, Oradea, but in Budapest.”

Coffee break

With high margins and an increasing popularity among the nouveau riche of eastern Europe, coffee shops are seen by some as a license to print money. With high margins and an increasing popularity among the nouveau riche of eastern Europe, coffee shops are seen by some as a license to print money.

With every millionaire and his or her husband, wife or mistress opening independent stores around the capital, the competition may be rife, but few brands have managed to lodge themselves in the public consciousness.

Turabo Cafe hopes to change that. The chain is interested in expanding to new Europe to take the battle to the competitive coffee market, rather than waiting for the battle to come to them.

Tough contenders include international chains Coffeeheaven and Gloria Jeans.

“We want to go where some of our competition has their businesses,” says general manager and owner Tudor Niculescu. “Some businesses in Prague and Sofia will come here and attack us in our position.”

At first, the priority is to consolidate its powerbase in Romania. 27 year-old Niculescu says Turabo is the largest coffee chain in Romania, with six outlets and will open between two and five in the centre of Bucharest next year, with one planned for Piata Romana.

Then comes Prague and/or Sofia, which Niculescu says the company will open with its own money. “First we want to do it ourselves. It's important the first two are a success, if not, our expansion will be hard,” he says.

But unit spaces are hard to find in Bucharest.

“If you find one, the rent is incredibly high; it may be easier to open in Paris or Milan.”

Hotels, office buildings and airports are also other possibilities for the brand. “We will open coffee shops where demand exists for cakes, meals and coffee,” says Niculescu.

The cafe's clientele tends to serve business people who make deals at lunchtime, young people who come around six or seven o'clock and then the Bucharest high life in the late hours, which opens until the last customer leaves.

About 40 per cent of the customers are foreign, 60 per cent Romanian and the class is noticeably higher than your average saloon.

“Unfortunately it is true that we have image of expense,” says Niculescu.

But he has introduced a variable pricing mechanism with an espresso priced at 5.2 RON in the centre of Bucharest, 3.8 in Iasi and 4.5 RON in Timisoara.

“It is not correct to charge customers the same price in Bucharest and Iasi. We adapt to the market in Romania.”

It costs on average between 100,000 and 150,000 Euro to set up a Turabo. In the middle of Bucharest the firm needs to invest more and in Iasi less.

So far the cafe has invested one million Euro and intends to invest two million next year. Next year it plans to open one coffee shop every month. As for expansion, Turabo has moved into catering and a fidelity card scheme, but is staying out of the off-trade.

“I do not think the market is ready yet for takeaway coffee,” says Niculescu. “We can give takeaways, but there is not the demand. We sell around ten per month. So why invest in it?”

He says that selling takeaway coffee will need a lot of marketing. It will mean developing a culture where at present there is none. “When we settle with growth, then we will develop this kind of activity,” he adds.

Turabo is also looking at the possibility of selling its concept to franchisees. Discussions are heated between potential partners in Chisinau and with three other business partners in Romania.

There are also plans to open a Turabo near Los Angeles, where there is a large Romanian expat community. “It is hard to find money to grow in the way that we want,” he adds.

“We cannot open 20 coffee shops with our own resources, so next year we will go to banks to find money or expand through a franchise concept.”

But Turabo is not for sale, says Niculescu. “It is a Romanian company owned by a Romanian and I want to keep it that way.”

However he adds that he could sell a part of the company, a minority stake of 20 to 30 per cent, to help fund its growth at a rapid rate on the European market.

Could this mean entering western Europe?

“Why not?” says Niculescu.

City Grill

No of outlets: Three. Eight by April 2006, one of which is a franchise.

No of employees: 240, around 500 by April next year.

Forecast turnover for 2005: 1.8 million Euro. 4.5 million for 2006

Ownership status: Private

La Mama

No of outlets: Four. Around 20 planned for 2007

Forecast turnover for 2005: 3.5 million Euro

Employees: 300

Ownership status: Private

Turabo Cafe

No of outlets: Six.

Predicted turnover 2005: 1.4 million Euro

Predicted profit 2005: 200,000 Euro

Ownership status: Private. Could consider selling a minority stake to fund expansion

Well-versed

Fildas is an example of a Romanian-owned business that imports, produces, distributes and sells pharmaceutical products, cosmetics and some foods in its own-branded branches. Fildas is an example of a Romanian-owned business that imports, produces, distributes and sells pharmaceutical products, cosmetics and some foods in its own-branded branches.

Its products include face cream Naturalis, which has seen demand from Mexico and Russia. The firm has also launched an organic mashed baby-food, to compete with Nestle and Milupa, which Vlad says has created a new niche on the Romanian market.

The next step includes creating a tea range.

“We are negotiating with a Romanian manufacturer for them to create for us our own recipe,” Anca Vlad, president of Fildas, tells The Diplomat.

Although offering comprehensive services, in import and distribution, Vlad says she is missing products from Swiss group Novartis.

“We have had them in our attention for many years now,” says Vlad.

Set up in 1991, the firm's main specialist area is wholesale distribution, which accounts for 80 per cent of the company's turnover.

Most of Fildas's products are distributed to local pharmacies, but there are a few which can only be found in its own Catena pharmacy. This is a franchise that Fildas has created and more than 120 units operate with independent ownership under its banner.

This year the firm has also opted for a new direction: TV.

Although Fildas has experience in media, having started a publishing house and a woman's magazine, Tonica, this was a new direction for Vlad. Six months ago Fildas bought an entertainment channel with a small audience, Pax TV station. The firm re-branded it Senso, targeting 20-45 year olds, promoting European movies, documentaries and culture - it's a less sensationalist channel, slower, gentler, and aiming to be more of a TV-with-a-heart than the main broadcasters.

But pharmaceutical distribution remains the core activity and next year. Vlad wants to open a representative office in Bulgaria and the UK.

Scream for cream

After 120 years of business, Farmec is one of the leading cosmetics providers on the Romanian market. Its signature product, anti-ageing cream Gerovital, is a 100 per cent local invention, a great brand name that gives spectacular results and is growing in international appeal. After 120 years of business, Farmec is one of the leading cosmetics providers on the Romanian market. Its signature product, anti-ageing cream Gerovital, is a 100 per cent local invention, a great brand name that gives spectacular results and is growing in international appeal.

Now the firm has more than 400 cosmetics, medicines and home care products on its portfolio.

Ten per cent of the company's turnover now comes from export.

“The Farmec products have an international recognition and can be found in more than 20 countries in Europe, America and Asia,” says general manager Liviu Turdean.

Recently launched internationally, Aslavital is the first anti-ageing cream that relies on a unique clay mined from Padurea Craiului Mountains, northwest Transylvania.

Today the company's strategy is centred on export and the management will analyse the possibility of opening Farmec branches abroad.

Over the next two to three years the firm will invest three million Euro modernising production and improving technologies. “The largest investment is the new section at Dezmir, Cluj county, to create an environmentally friendly aerosol and a hair spray. This will be unique in Romania,” says Turdean.

Fildas

Pharmaceutical distributor and mixed interest group

Owner of Senso TV and the Catena brand

Units: 120 pharmacies under the 'Catena' banner

2005 predicted turnover: 140 million Euro

Ownership status: Private

Farmec

Cosmetics producers

Turnover 2004: 15 million Euro. A 15 per cent increase is predicted for 2005.

Predicted profit for 2005: 1.8 million Euro

Markets abroad include Japan, Spain, Germany, Italy, France, USA, Kuwait

No of employees: 1,000

Ownership status: privatised in1995 through mass privatisation (MEBO)

Finance options

Older than the Central Bank, Romania's Savings Bank CEC has the largest network of banks, 1,405, and is slated for sale in the next few months to one of several foreign banks. Older than the Central Bank, Romania's Savings Bank CEC has the largest network of banks, 1,405, and is slated for sale in the next few months to one of several foreign banks.

But this has not stopped the bank from carrying out far reaching expansion plans.

CEC's CEO Eugen Radulescu, tells The Diplomat: “This bank has potential, so all the plans consider its future. Rumour had it that the bank will be sold for 300 million Euro, but we're worth more and will probably get more.” Reuters has quoted a 600 million Euro value that some international banks may be willing to pay.

Preparing itself for the takeover, but not before May 2006, CEC is reorganising. New products include the launch of debit cards and the opening of units, says Radulescu.

Sackings are also taking place. 1,300 have lost their jobs at CEC in the last year, but it is not in their plan to make further redundancies in 2006. “We will also be making switches between the back office staff and the front office in terms of number of people,” says the CEO.

Results are starting to appear, with Radulescu seeing an increase of 33 to 55 million Euro over one month in the consumer credit niche and increase of up to 15 per cent in company loans.

“I am looking at similar banks to CEC in Romania's nearest countries such as the Czech Republic, Poland, Slovakia and Hungary. They are now the biggest banks,” says Radulescu. “We had a market share of ten per cent in 2000, but in the following years it decreased to 4.5 per cent today. Next year we hope to gain back our market share from 2004, which stood at 5.7 per cent.”

Fast developer

Set up in 1993 by a group of intrepid Cluj-Napoca businessmen, Banca Transilvania (BT) has moved from its namesake region to become one of the more attractive and dynamic Romanian-owned banks. Set up in 1993 by a group of intrepid Cluj-Napoca businessmen, Banca Transilvania (BT) has moved from its namesake region to become one of the more attractive and dynamic Romanian-owned banks.

“Despite the fact that it is a local bank, Banca Transilvania is soon set to become Romania's most important bank with 100 per cent local capital,” says general manager Robert Rekkers.

Banca Transilvania has opened a further 75 units this year to rise the number to 193. A further 20 branches are planned to open by the end of this year. It was also the first in Romania to introduce the 'cafe' concept to the branch where a customer can drink a cappuccino, read a newspaper or watch Bloomberg business news in a cosy Banca Transilvania-branded atmosphere. This idea was picked up by ING and BCR.

Over the last three years, Rekkers says development was done in stages, but quickly, focusing first on strengthening BT's presence in Transylvania, before going national.

Banca Transilvania has also aimed to position itself as the No. 1 bank for small and medium enterprises.

“To support this, the bank has launched two types of credits to support SMEs: '1 Hour Credit' and 'Start Up',” says Rekkers.

The general manager says the biggest challenge the bank encountered was maintaining and increasing quality considering the bank's own fast-paced development, which needed a state of the art IT system.

Going universal

Following a switch in strategy from an energy sector bank to providing universal services, private bank Romexterra is now on a branch opening drive. Following a switch in strategy from an energy sector bank to providing universal services, private bank Romexterra is now on a branch opening drive.

With a network of 37 units, the bank aims to open three more by the end of the year and 29 in 2006.

With consolidation in the banking market due in the next few years, the bank says it does not rule out a takeover, but may consider selling a minority stake to an investment fund.

Romexterra has had the label of an 'energy bank'. But the past three years has seen the bank's strategy focusing on transforming to a general service, targeting mainly individuals, SMEs and corporations.

“If we look at Romexterra's client base, the perception of it as a 'bank for oilmen' or an 'energy bank' is continuously fading,” president Romexterra Adrian Radu tells The Diplomat.

With international banks, who have not managed to purchase both state banks BCR and CEC, telling The Diplomat that, they may be willing to buy dynamic private banks in Romania, Radu says it is likely the bank's management would consider such an offer, if it should appear.

“At the last general shareholders meeting, the bank's Board of Administration has been authorised to look into the opportunity of accepting a minority stakeholder, such as a kind of private investment fund,” he adds.

But he does continue: “I don't know if we can talk about a potential takeover. But the bank has very clear and attractive features: a very comfortable financial position, good capitalisation, good quality of assets as reflected in the recent improved rating given by S&P, good territorial coverage, and we're ranked number seven in the top banks in Romania, from the point of view of ATMs and cards issued.”

Romexterra Bank is part of the Romexterra Financial Group, together with Romexterra Leasing, Romexterra Finance and Petro As.

CEC: Casa de Economii si Consemnatiuni - Romania's Savings Bank

Founded: 1864

No of units: 1,405

Employees: 7,800

Ownership status: State. In the process of being privatised. Seven foreign banks had still expressed an interest, as we went to press

Banca Transilvania

Founded: 1994

No of units (by the end 2005): around 213

Employees: 2,952

No of clients: 750,000 (individuals and companies)

Market share (June 2005): 3.4 per cent

Assets (Sep 2005): 1.16 billion Euro

Profit (Jan to Sep 2005): 20.6 million Euro

Ownership status: Private

Romexterra Bank

No of units: (end of 2005) around 40

Profit: Increased by 167 per cent at the end of the third quarter, compared to same period 2004.

Assets: Around 207 million Euro - up 31 per cent on 2004.

Employees: 731

Ownership status: Private. Not ruling out takeover or selling minority stake

Soft touch

“Five years ago we had a booth at the biggest IT show in world, Hanover CeBit. When we met potential clients, we used to start our conversation with: 'We are from Romania'. A quarter used immediately to leave the conversation,” says Florin Talpes, general manager of Softwin. “Soon we stopped them and asked why. The reason was that they thought: 'you are coming from a poor country. Poor country means poor education. That education cannot deliver high technology. So I should not expect it from you'.”

But the opposite was the case.

“In maths and science, we have one of the best education systems in the world,” says Talpes. “And the finest people. This is the product of the Communist system learning in science. Science is a good base for IT. And security software is very connected to that.”

Now if you ask someone visiting an IT shop to name an IT security product, there is a good chance they will nominate Softwin's signature project, BitDefender, says Talpes.

This is most sold IT product sourced from eastern and central Europe and has around 30 per cent of its sector market in France, Belgium and Switzerland.

Now with a good brand, Talpes says that Softwin is not for sale.

“We have had a lot of offers,” he says. “Till now we did not consider selling the company.” But he does say that he is “evaluating investment opportunities” of other companies in specific Softwin projects. Whether or not he will seek funding through this stream will be clear in six months. Three years ago the firm planned to list on the Bucha-rest Stock Exchange. Now Talpes says he is “studying the opportunity” to list some business on the stock exchange, either in Romania or abroad. “It's possible next year we will make a decision.”

The brain drain is also decelerating in IT. In 2001, Talpes says 30 per cent IT graduates used to go abroad two years after graduation. Now it is two to three per cent. “Today we do not talk about a real threat,” he says. “But once we join the EU, we could see another wave.”

But many IT experts are coming back to Romania with experience of abroad - and to Softwin.

America calling

Romania's GeCad kept the headlines a couple of years ago when its RAV antivirus program was sold to software giant Microsoft. Romania's GeCad kept the headlines a couple of years ago when its RAV antivirus program was sold to software giant Microsoft.

Since then, Radu Georgescu's enterprise has focused on running its local business, which now incorporates five distinct companies in areas from IT security to online payments services, and messaging solutions as well as exporting some of its software for the market abroad.

Georgescu says around 80 per cent of the Romanian IT market is very much linked to Government money, which is the biggest buyer of IT and software, while the remainder undertakes 'outsourced' services for larger, mostly western, companies in areas such as programming and design.

But GeCad is rare as it has no connection with the state.

Georgescu started the company in 1992 with 1,500 USD and invested about three million USD by 2003.

“After that year, some five million Euro was invested in all five companies of the group,” says Georgescu. “At this moment, there is no need for another investment in any of the companies and more than that, it is possible that GeGad could be interested in making an acquisition.”

He adds that all GeCad's companies have independent projects for next year, all related to seeing development on the international market.

GeCad

Software group

Sold RAV antivirus to Microsoft in 2003

Software for IT security, call centre outsourcing, online payments and online sales increasing services, messaging solutions, business services.

2004 turnover: four million Euro

Ownership status: Private. The firm is interested in making possible further acquisitions.

Softwin

Software company specialised in data security, business intelligence, portals, EContent and Customer Relationship Management

Partners include: SAP, Oracle, Microsoft and IBM

Employees: 800

Turnover predicted for 2007: over 100 million Euro

Ownership status: Private. Evaluating investment opportunities in specific projects.

Ghost Buster

“Being independent allows us to make our own rules,” says Dragos Grigoriu, president of Tempo Advertising, one of the few Romanian-owned advertising agencies. No affiliations to a global ad firm such as Publicis or WPP for this nine-year old company. “Being independent allows us to make our own rules,” says Dragos Grigoriu, president of Tempo Advertising, one of the few Romanian-owned advertising agencies. No affiliations to a global ad firm such as Publicis or WPP for this nine-year old company.

“Even if we're independent, we have solutions for any situation; we have a strong character, we are spontaneous, we're even top of the class when we prepare hard,” says the president.

Having stepped back from running his agency for almost three years, Grigoriu took back the helm about five months ago.

“Thus I had the chance of looking at things from an outsider's perspective,” he tells The Diplomat. He says that, if five years ago Tempo was mostly renowned for its creative efforts, in the meantime things have changed, including its PR department, which has grown immensely. Grigoriu would position his agency halfway on a scale from one to ten in the top of local advertising firms.

“As an agency we do not 'engineer contests',” says the president. “I prefer to build something that produces an honest outcome for our clients, not stress myself and my people with winning awards at advertising festivals.”

Grigoriu feels the local advertising market has reached its 'unethical' peak. “Young people that enter this industry are constantly taught the wrong values.”

This includes making adverts, in print or film, which are never released, but are geared to win awards: ghost campaigns.

“Many contests lose their credibility, as I believe an advertising contest should award innovation, novelty and trend-setting campaigns, not 'ghosts',” he says. “I'd like to organise a 'ghost contest' and I wish the winners would make their living exclusively from clients like these.”

With everybody having 2007 as a threshold, Grigoriu sees things differently.

“All will look towards affiliations or takeovers. It is not necessarily good news, but on the other hand, we are quite well known for our ability to adapt,” he says.

Tempo Advertising

No of employees: 63

Turnover 2004: Eight million Euro

Profit 2004: 203,000 Euro.

Portfolio includes Banca Tiriac, Baneasa Investments, Danone, European Foods, F.Hoffmann - La Roche, Orange Romania, Tuborg, Visa, Xerox

Easy meat

Just after the Revolution, Radu Timis first invested 700 USD in a family owed kiosk, buying up different types of sausages and selling them directly to the public. Then he set up his first butchery, producing 500 kilograms of meat per day. Just after the Revolution, Radu Timis first invested 700 USD in a family owed kiosk, buying up different types of sausages and selling them directly to the public. Then he set up his first butchery, producing 500 kilograms of meat per day.

Now things have changed and his company Cris Tim, plans to have 40,000 pigs next year and is poised to invest up to 16 million Euro in new warehouses, production and logistics facilities, to support its leading market position in sausages and salami.

“We are about to finish a new logistics centre, stretching over 6,500 sqm, an investment of about three million Euro, which will help us deliver around 150 tonnes of products in eight hours,” Timis tells The Diplomat. “We have our own farm, with around 20,000 pigs and aim to double the number next year.”

Cris Tim last year posted a turnover of 120 million Euro and forecasts 160 million Euro for this year. “In 2006 we forecast an increase of 40 per cent,” Timis says.

To support its local business, Timis says Cris Tim has its own distribution network and nine regional warehouses.

“All Cris Tim products are made at our plant in Filipestii de Padure, Dambovita county, which can deliver 150 tonnes per day, but the sales are around 100 tonnes per day,” says Timis. “In the next weeks we will open a new factory, which covers 6,500 sqm and respects all European standards in an investment of five million Euro. With the new production capacity we will be able to produce around 180 tonnes per day.”

The president says his company enjoys a market share of 20 to 22 per cent, and aims for 30 per cent by 2010. Preparing itself for EU integration, Cris Tim has already started to supply western markets, such as Greece and Italy. Selling his company is not an option, Timis says, although he wonders how many local producers would be able to keep up with EU standards after the integration.

Cris Tim

Processed meat producer

2004 turnover: 120 million Euro

2005 predicted turnover: 160 million Euro

Produces 180 tonnes of meat products per day

Exports to countries such as Italy and Greece

Ownership status: Private. Not looking for a foreign buyer

Safe bet

After 15 years of local development, security systems integrator UTI has already gone international, with projects in Kazakhstan, Egypt, the Republic of Moldova and Belgrade. “We have a firm in Italy we are cooperating with and we are already participating in auctions on the Italian market” president UTI Tiberiu Urdareanu tells The Diplomat. After 15 years of local development, security systems integrator UTI has already gone international, with projects in Kazakhstan, Egypt, the Republic of Moldova and Belgrade. “We have a firm in Italy we are cooperating with and we are already participating in auctions on the Italian market” president UTI Tiberiu Urdareanu tells The Diplomat.

Romania is “the priority” in terms of development, says the president. “But for now we will try to move to the nearest countries to Romania and to the Near East.”

Moreover, the firm is turning into a holding, as it owns eight companies and is in the process of a six-month restructuring.

“This year UTI created the military systems division, and lately worked a lot in the national security field, a closed system, with a culture and special language so UTI created this new division to communicate better with the client,” he says.

Through its Military Systems Division, UTI provides integrated solutions designed for defence, public order and national security enforcement. He believes that in two to three years this division will grow and become a prosperous business.

Back in the 1990, UTI's activity first started as a distributor of IT equipment, meanwhile the security systems opportunities (delivering and installing alarm systems) for the company started two years later. As things developed, projects began in banking security and with power plants, such as nuclear facility Cernavoda. That project allowed UTI to offer complex security services and today the company is the market leader in this segment covering all demands, from airport to supermarkets and the home.

UTI security company

Four business areas: security systems and services, IT & C, military systems and construction.

Forecast turnover for 2005: 60 million Euro

Forecast profit for 2005: 8.5 million Euro

No of employees: 3,716

By Ana-Maria Smadeanu,

Michael Bird and Corina Mica |

|

Czeching it out

Small but dynamic, the Czech Republic has become one of the most active members of new Europe on the local market, as Anca Pol tracks the nation's move from trade partner to investor

One of the most successful post-1989 nations and a popular tourist magnet, the Czech Republic is seen in the west and east as a blueprint of how a former communist country can create a dynamic market economy and a fair social system at the same time. One of the most successful post-1989 nations and a popular tourist magnet, the Czech Republic is seen in the west and east as a blueprint of how a former communist country can create a dynamic market economy and a fair social system at the same time.

Although its kids are better in foreign languages than their Czech peers, Romania could still go some way in communicating a similarly positive image to investors.

But ice hockey fan and history graduate, Ambassador of the Czech Republic to Romania Radek Pech admits the transition has not been easy for Romanians.

“I admire very much their patience and their ability to adapt, to adjust themselves to the new situation,” says Pech about the Romanians, “to live through the transformation process in order to become an EU member by January 2007.”

The Czech Senate has already ratified Romania and Bulgaria's Accession to the EU Treaty and, according to the Ambassador, a recent opinion poll showed that most Czechs are not against Romania and Bulgaria's accession to the EU. Yet, attitudes to the two countries differ. Over 60 per cent of the respondents were pro-Bulgaria, while only 49 per cent were in total favour of Romania's entry.

There are two reasons for this difference, says Pech.

“Bulgaria is better known than Romania.” Many Czechs go on holiday to Bulgaria, for example, but fewer to the northern neighbour. “Secondly, Romania's reputation is worse than Bulgaria's.”

It is a common complaint that Romania needs to work on its image.

Many well-educated young people are among Romania's assets, Pech believes. Yet the brain drain is more of a reality here than back in his home country.

The Czech Republic has not been confronted with this issue as much as Romania. “We are not as moveable a nation,” he says. “And our young people are not as good at foreign languages as Romanian youngsters are.”

A more attractive situation also helps.

“The living standards are relatively high in the Czech Republic,” he says, “and the social protection system is quite generous.”

The number of Czechs working abroad is smaller and those working illegally are few, according to the Ambassador. Another dissimilarity is the country's homogenous living standards between rural and urban areas. “Only four per cent of the Czechs living in the countryside depend on agriculture,” he says.

The Czech Republic is also poised to expand its foreign relations. At present Pech's jurisdiction also covers the Republic of Moldova, but a new embassy in Chisinau will open by the end of this year.

BUILDING ON TRADE

The export of cars, chemical and heavy industry products, glass, pharmaceuticals and paper from the Czech Republic to Romania has been the base of not very vivid economic trade relations until recently. The export of cars, chemical and heavy industry products, glass, pharmaceuticals and paper from the Czech Republic to Romania has been the base of not very vivid economic trade relations until recently.

Things are changing, according to Karel Zdenovec, commercial counsellor at the Czech Embassy to Romania.

Relations are moving from simple import-export from Czech-based firms to one of manufacture and retail.

Zdenovec says Czechs took their time because they needed to gain business savoir faire and enough technological development to break into Romania.

But image, again, was a problem.

“Romania did not have a positive notoriety,” Zdenovec says “[Czech] people were, in principle, afraid to invest in Romania.”

Romania also lacked the necessary incentives to make the nation attractive for investors in general, another situation that is changing. As for problems Czech businessmen face in Romania, again in comes down to bureaucracy and corruption. “Things are moving in the right direction,” he says. “For example, we feel that, when open tenders are set up, those organising them do their job much more carefully than before, because they are afraid of being accused of corruption.”

Manipulated tenders continue to exist, says Zdenovec, but their occurrence is decreasing.

A record number of 40 Czech companies were present at the International Bucharest Fair at Romexpo last October. Heavy machinery is a powerful branch of the Czech industry and, according to Zdenovec, it sells well in Romania. Czechs are also interested in developing relations in the energy field, IT, infrastructure and ecology.

Energy firm CEZ has already bought Romanian power distributor Electrica Oltenia and is one of the suitors of fellow firm Electrica Muntenia Sud, a southern district which also covers Bucharest.

In Romania's waste water management, an area where the World Bank has estimated 20 billion Euro is needed to restructure, there could be potential for Czech-Danish company DHI Hydroinfo. The firm has expertise in anti-flood protection systems - useful in predicting the 2002 Prague floods - and is in contact with the Romanian ministries to start floods-prognosis and anti-flood protection projects.

What could Romania give in return? For starters, says Zdenovec, a more pro-active attitude. “Romanian companies are always a bit passive,” he says. “They either have other priorities or they are hesitant in cooperating with foreign companies, but this will change in time.”

MEDICINE BOOST

One of the largest international generic medicine producers, Zentiva, signed last October a deal for the acquisition of 51 per cent of local pharmaceutical producer Sicomed.

This comes after Zentiva concluded in 2003 the acquisition of Slovakian medicine producer Slovakopharma.

“There will be a re-branding [of Sicomed] under the Zentiva name and this will be a process which will last, according to our Slovakopharma experience in 2003, a year to 18 months,” Mariana Wencz, Zentiva country manager Romania tells The Diplomat.

Nevertheless, some Zentiva products have been available on the Romanian market since 2000, including Sivacard, a medicine taken by patients with cardio-vascular problems.

So far Sicomed has been number one in Romania in sold units of generic medicines, with a market share of 25 per cent in sold units and five per cent in value.

In Romania, Zentiva now plans to become, in the mid term, number one in terms of value in this sector, aiming at an eight per cent market share in value and a 30 per cent market share in sold units.

Educational projects aimed at family doctors will also be organised with the official authorities. According to the country manager, tackling drugs for the primary care field has been the recipe for the company's success so far.

This was its strategy for the Czech Republic and Wencz says Romania is in a similar situation to the new European country ten years ago.

Zentiva products will mainly focus on the circulatory and cardio-vascular systems, the central nervous system, gastro-intestinal and pain, urology, gynaecology and feminine products such as birthcontrol pills.

To these, non-prescriptive or over the counter (OTC) medicines are added.

Zentiva also intends to put on the market around 20 new pharmaceutical brands in the next three years.

On the other hand the per capita medicine consumption of the Romanians is still arguably low.

“If we were to compare ourselves with neighbouring countries, we should have a medicine consumption that is four times higher, but an increase will come anyway along with the European integration,” says Wencz.

According to her, the Czech group could extend, after Romania, into other countries such as Poland, Hungary and Ukraine.

PIPE IT UP

In pipe systems, the Czech branch of the Swiss-based mother company Hobas last year bought a factory in Clinceni, Ilfov county, for over four million Euro and is now looking to expand its production further.

This followed a previous investment of 200,000 Euro in the modernisation of the factory.

The Hobas factory now produces centrifugally-cast glass fibre reinforced piping.

“One of the main projects of Hobas Pipe Systems, finalised in 2004 in Craiova, was a first for Romania,” Richard Vlcek, Hobas administrator for Romania tells The Diplomat. “In December 2004, Hobas pipes were installed by the jacking method, which means that trench-digging is no longer required, minimising costs and the impact on the environment.”

Vlcek says that a new production hall for fittings and jacking pipes is due to be built in the coming years. Also, the owners intend to improve the existing production equipment to widen the product range, offering pipes with a bigger diameter - an investment which would be around 1.5 million Euro.

CAN-DO ATTITUDE

Czech processed food firm Hame was exporting products to Romania when it decided to buy can factory Romconserv Caracal, Olt county.

Now Hame Romania sells ready meals, canned meat and pates locally, with pork liver pate one of the most popular products.

Besides the amount invested in the acquisition, the Czech company intends to rebuild the plant to make it compliant with EU regulations.

“Millions of Euro will be invested [in zthe reconstruction], just the walls will remain [out of the old building],” Petr Subrt, Hame Romania general manager tells The Diplomat.

Hame Romania products are only sold on the Romanian market, but after the nation's EU accession, the firm will export them to Bulgaria, Hungary and Serbia.

In the Czech Republic, Hame has around 1,200 products, such as ketchup, jams, canned vegetables, salads and baby food.

“We intend to bring all of them to Romania, depending on the local purchasing power and on the local taste, but the market is not ready yet,” Subrt says.

SECOND CHANCE

Czech Republic-based car dealer AAA Auto officially opened its first Militari auto park this September providing the financing opportunities, insurance and a warrantee of around 90 days for second hand vehicles. Czech Republic-based car dealer AAA Auto officially opened its first Militari auto park this September providing the financing opportunities, insurance and a warrantee of around 90 days for second hand vehicles.

By the end of this year the firm targets sales of 1,000 and 2,500 cars for 2006. The Peugeot 206, the Audi A4, Opel Astra, Ford Mondeo and Volkswagen Passat have been popular so far.

The Audi A8 is arguably the most expensive, at a cost of 28,000 Euro, whereas the classic Dacia 1310 is priced at a lowly 2,000 Euro.

“Romanians like Dacias. It's not a glamorous car, but it's a car built for Romanian conditions,” country manager AAA Auto Ruskin McLennan says.

But he argues the market share for Dacia will reduce as the auto market becomes more diverse.

Despite a tendency to remain for the moment faithful to Dacias, he adds: “Romanians want to drive German cars. They love exciting and sporty cars.”

This is different to the Czechs, who are more pragmatic, says McLennan. Also, the AAA Auto country manager finds that Romanian people like imported cars and seem more confident about them, because they know they have been serviced and have been driven on western European roads.

AAA Auto plans to open another sales park in Militari, Bucharest, plus others in Constanta, Timisoara and Brasov in the next 12 months.

The mother company also intends to expand to Bulgaria, Ukraine, Serbia and possibly Slovenia, Hungary and Poland.

FLIGHT PLAN

CSA, the Czech Airlines, started operating flights on the Prague-Cluj-Bucharest route back in 1933, the second international flight operated by CSA.

Tourists are its main clients from around 70,000 passengers to and from Romania in 2004, according to Zdenek Kral, CSA Romania director, although business travel is constantly growing. CSA Romania also offers mailing and cargo services for a very wide range of merchandise items.

“Through Romania's integration in the EU and the implementation of the acquis, Czech Airlines will succeed in strengthening its presence on the Romanian market by starting flights to new destinations and by increasing the number of flights on the routes already operated with our partner, Tarom,” Kral tells The Diplomat.

READY TO BUILD

Czech engineering and construction company PSG entered the local market this July attracted by the EU potential. Since opening its Bucharest office, PSG Romania's board has been active in tying up business contacts.

“We have found interesting business opportunities mainly in the construction of commercial and civic facilities - that is shopping and wholesale centres - residential developments and in the industrial sector,” says Ivan Vesely, director for strategy and business development of PSG International in Romania.

“Romania has endless opportunities in all areas of construction and there is a lot of work to be done, in infrastructure, housing developments and in the civic area,” says Vesely.

At present, PSG Romania is involved in securing a construction deal worth five million Euro.

|

RADEK PECH, AMBASSADOR OF THE CZECH REPUBLIC TO BUCHAREST |

Age: 42

Appointed to the post: 2002

Marital status: married, with two sons

Education: Charles University, Prague and Diplomatic Academy, Vienna

Previous postings: Ministry of Foreign Affairs of Czechoslovakia, (1992-1993) and the Czech Republic (1993-1997), Ambassador to Estonia and Finland

Foreign languages: English, German, Russian, Romanian

Hobbies: Literature, film, music, watching ice hockey and collecting sports statistics |

|

Electrowares retailer Altex does not rule out a sale to an investor, but says it could still play as an independent.

Electrowares retailer Altex does not rule out a sale to an investor, but says it could still play as an independent.  Romania's second largest electrowares retailer, Domo, is currently undergoing a re-branding process, aiming at extending its range of products and expanding abroad, CEO Lorand Szarvadi tells The Diplomat.

Romania's second largest electrowares retailer, Domo, is currently undergoing a re-branding process, aiming at extending its range of products and expanding abroad, CEO Lorand Szarvadi tells The Diplomat. Romania's largest private company, locally-funded and Netherlands-based Rompetrol Group, was founded back in 1974 as Romania's international arm in the oil and gas industry and privatised in 1993 through the mass privatisation, MEBO, method.

Romania's largest private company, locally-funded and Netherlands-based Rompetrol Group, was founded back in 1974 as Romania's international arm in the oil and gas industry and privatised in 1993 through the mass privatisation, MEBO, method. With high margins and an increasing popularity among the nouveau riche of eastern Europe, coffee shops are seen by some as a license to print money.

With high margins and an increasing popularity among the nouveau riche of eastern Europe, coffee shops are seen by some as a license to print money. Fildas is an example of a Romanian-owned business that imports, produces, distributes and sells pharmaceutical products, cosmetics and some foods in its own-branded branches.

Fildas is an example of a Romanian-owned business that imports, produces, distributes and sells pharmaceutical products, cosmetics and some foods in its own-branded branches. After 120 years of business, Farmec is one of the leading cosmetics providers on the Romanian market. Its signature product, anti-ageing cream Gerovital, is a 100 per cent local invention, a great brand name that gives spectacular results and is growing in international appeal.

After 120 years of business, Farmec is one of the leading cosmetics providers on the Romanian market. Its signature product, anti-ageing cream Gerovital, is a 100 per cent local invention, a great brand name that gives spectacular results and is growing in international appeal.  Older than the Central Bank, Romania's Savings Bank CEC has the largest network of banks, 1,405, and is slated for sale in the next few months to one of several foreign banks.

Older than the Central Bank, Romania's Savings Bank CEC has the largest network of banks, 1,405, and is slated for sale in the next few months to one of several foreign banks. Set up in 1993 by a group of intrepid Cluj-Napoca businessmen, Banca Transilvania (BT) has moved from its namesake region to become one of the more attractive and dynamic Romanian-owned banks.

Set up in 1993 by a group of intrepid Cluj-Napoca businessmen, Banca Transilvania (BT) has moved from its namesake region to become one of the more attractive and dynamic Romanian-owned banks.  Following a switch in strategy from an energy sector bank to providing universal services, private bank Romexterra is now on a branch opening drive.

Following a switch in strategy from an energy sector bank to providing universal services, private bank Romexterra is now on a branch opening drive.  Romania's GeCad kept the headlines a couple of years ago when its RAV antivirus program was sold to software giant Microsoft.

Romania's GeCad kept the headlines a couple of years ago when its RAV antivirus program was sold to software giant Microsoft. “Being independent allows us to make our own rules,” says Dragos Grigoriu, president of Tempo Advertising, one of the few Romanian-owned advertising agencies. No affiliations to a global ad firm such as Publicis or WPP for this nine-year old company.

“Being independent allows us to make our own rules,” says Dragos Grigoriu, president of Tempo Advertising, one of the few Romanian-owned advertising agencies. No affiliations to a global ad firm such as Publicis or WPP for this nine-year old company. Just after the Revolution, Radu Timis first invested 700 USD in a family owed kiosk, buying up different types of sausages and selling them directly to the public. Then he set up his first butchery, producing 500 kilograms of meat per day.

Just after the Revolution, Radu Timis first invested 700 USD in a family owed kiosk, buying up different types of sausages and selling them directly to the public. Then he set up his first butchery, producing 500 kilograms of meat per day. After 15 years of local development, security systems integrator UTI has already gone international, with projects in Kazakhstan, Egypt, the Republic of Moldova and Belgrade. “We have a firm in Italy we are cooperating with and we are already participating in auctions on the Italian market” president UTI Tiberiu Urdareanu tells The Diplomat.

After 15 years of local development, security systems integrator UTI has already gone international, with projects in Kazakhstan, Egypt, the Republic of Moldova and Belgrade. “We have a firm in Italy we are cooperating with and we are already participating in auctions on the Italian market” president UTI Tiberiu Urdareanu tells The Diplomat.  One of the most successful post-1989 nations and a popular tourist magnet, the Czech Republic is seen in the west and east as a blueprint of how a former communist country can create a dynamic market economy and a fair social system at the same time.

One of the most successful post-1989 nations and a popular tourist magnet, the Czech Republic is seen in the west and east as a blueprint of how a former communist country can create a dynamic market economy and a fair social system at the same time.  The export of cars, chemical and heavy industry products, glass, pharmaceuticals and paper from the Czech Republic to Romania has been the base of not very vivid economic trade relations until recently.

The export of cars, chemical and heavy industry products, glass, pharmaceuticals and paper from the Czech Republic to Romania has been the base of not very vivid economic trade relations until recently.  Czech Republic-based car dealer AAA Auto officially opened its first Militari auto park this September providing the financing opportunities, insurance and a warrantee of around 90 days for second hand vehicles.

Czech Republic-based car dealer AAA Auto officially opened its first Militari auto park this September providing the financing opportunities, insurance and a warrantee of around 90 days for second hand vehicles.  Romania is seeing growing interest from Japan in the vehicle parts sector, but the eastern nation is still holding back from using its European partner as a base for large scale manufacture in cars or electronics.

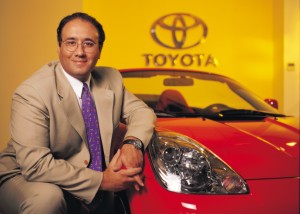

Romania is seeing growing interest from Japan in the vehicle parts sector, but the eastern nation is still holding back from using its European partner as a base for large scale manufacture in cars or electronics. Japanese cars are increasing their presence and Toyota now sells around 4,000 vehicles per year in Romania.

Japanese cars are increasing their presence and Toyota now sells around 4,000 vehicles per year in Romania.  IT and communications is one of the most dynamic sectors in Romania. Here Japan is represented by fibre-optic cable manufacturer Fujikura Tokyo, which has only one other major European office, in the UK.

IT and communications is one of the most dynamic sectors in Romania. Here Japan is represented by fibre-optic cable manufacturer Fujikura Tokyo, which has only one other major European office, in the UK. YKK is managing to buck the trend of clothing and accessory manufacturers banking only on the Far East, by setting up in Europe, which has the advantage of being close to major consumer markets.

YKK is managing to buck the trend of clothing and accessory manufacturers banking only on the Far East, by setting up in Europe, which has the advantage of being close to major consumer markets.